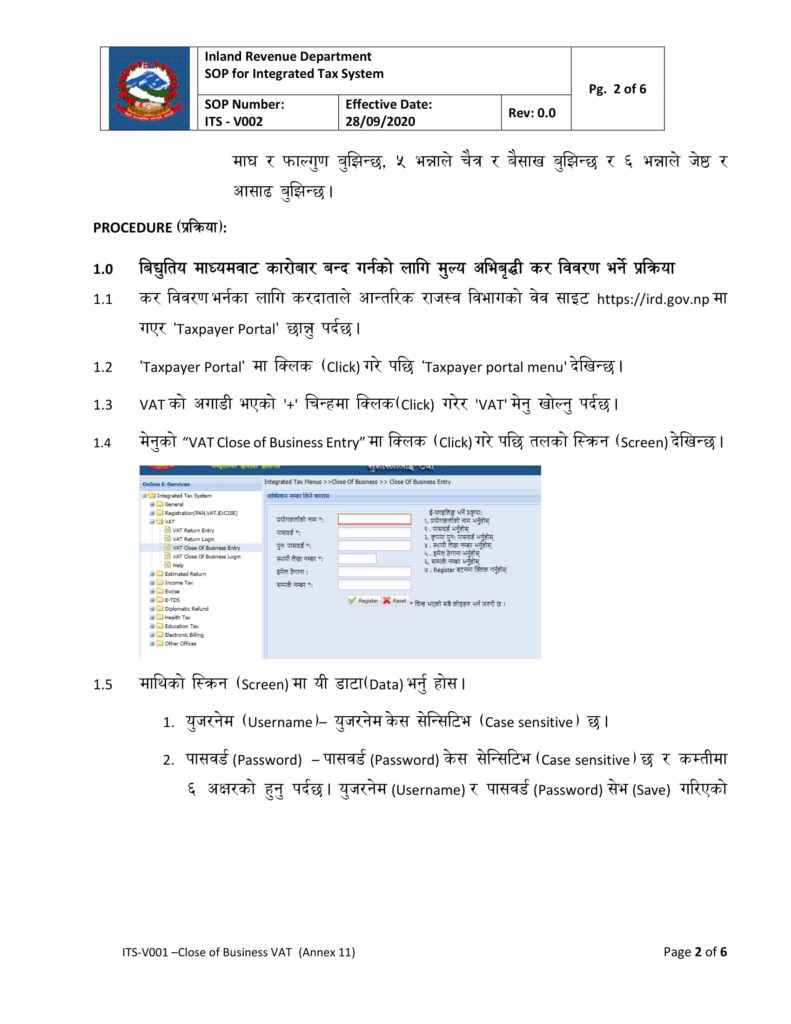

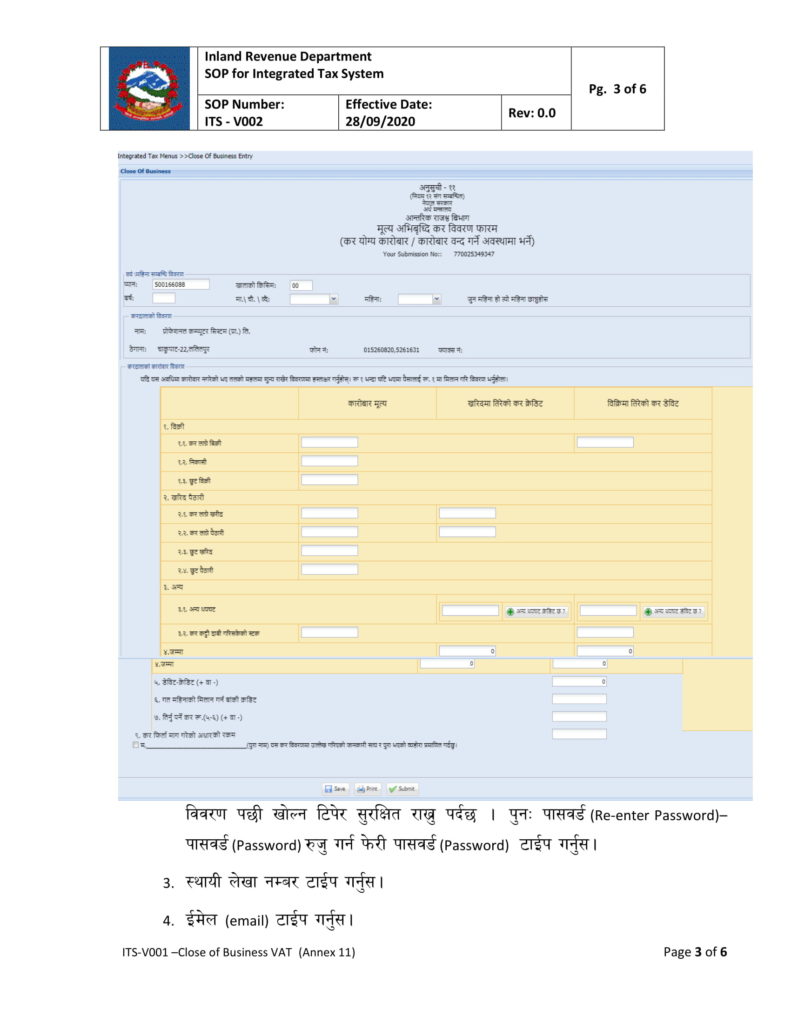

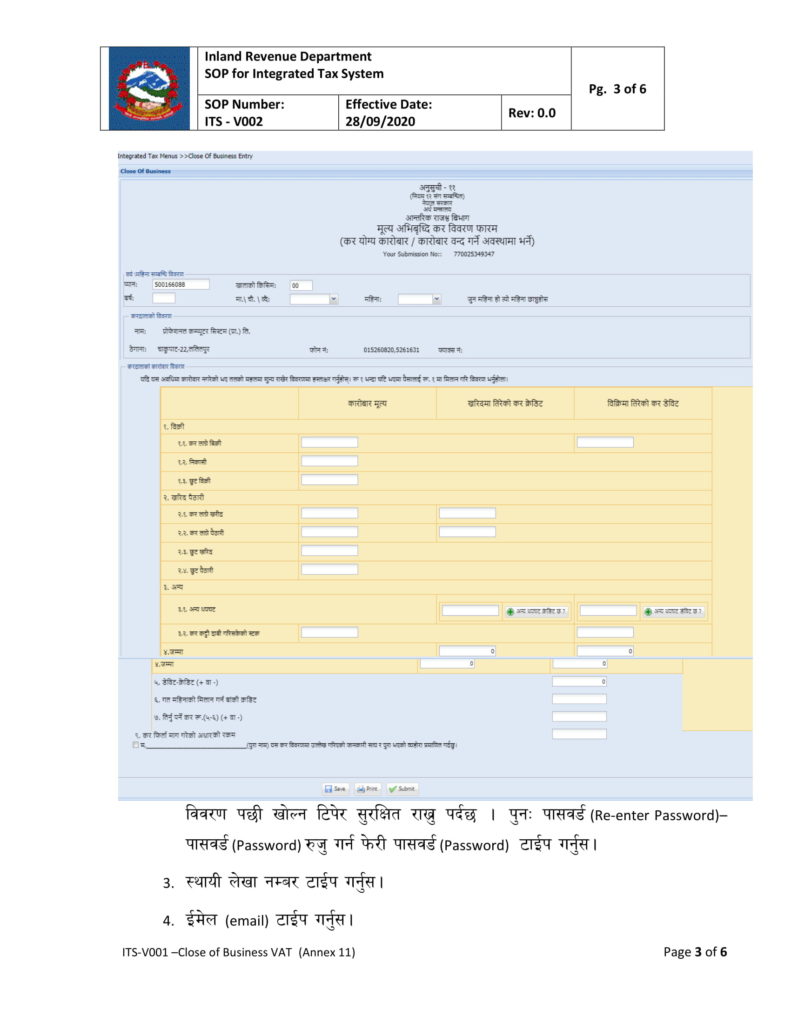

Schedule 11 is mandatory for closure of vat or incase of closure of business registered in Vat.

Schedule 11 in case of closure of Vat is verified by Tax officer and than ultimately vat will be inactive, than only one can proceed to Business closure.

Professional Hub

Of Advisors Pvt. Ltd.

Schedule 11 is mandatory for closure of vat or incase of closure of business registered in Vat.

Schedule 11 in case of closure of Vat is verified by Tax officer and than ultimately vat will be inactive, than only one can proceed to Business closure.